AI Financial Advisor

Conversational AI-powered personal finance platform that transforms transaction data into actionable insights through natural language interaction.

Project Details

Role

Full-Stack Developer

Timeline

December 2025

Team

Solo developer

Platform

Web

Status

LiveTechnologies

Key Features

- Conversational AI interface powered by Claude with 24 specialized financial analysis tools

- Intelligent transaction categorization using AI to automatically classify spending

- Proactive insights engine that detects spending patterns and recommends optimizations

- Real-time budget tracking with approval workflows for AI-suggested changes

- Comprehensive dashboard with net worth tracking, cash flow analysis, and spending breakdowns

The Problem

Young professionals have unprecedented access to financial data through banking apps, yet most struggle to maintain meaningful financial awareness. Traditional budgeting apps require extensive setup, force users into rigid systems, and demand ongoing maintenance—leading most users to abandon them within weeks. What's missing is a tool that transforms passive transaction data into conversational, personalized guidance.

The Solution

AI Financial Advisor provides a personal finance analyst that makes spending analysis as natural as having a conversation. Users can ask questions like "How can I cut down spending this month?" or "Where am I overspending?" and receive data-driven answers with visualizations and actionable recommendations.

AI-Powered Analysis

The conversational agent has access to 24 specialized tools organized into four categories: analysis tools for querying transactions and detecting patterns, budget tools for creating and managing spending limits, display tools for rendering visualizations, and insight tools for proactive recommendations. When users approve AI-suggested budget changes, inline approval cards prevent accidental modifications.

Proactive Insights

The insights engine automatically identifies financial opportunities and risks—from redundant subscriptions to emerging spending issues. Each insight includes specific recommendations with estimated savings, and users can discuss any insight with the AI to explore related data or implement suggestions.

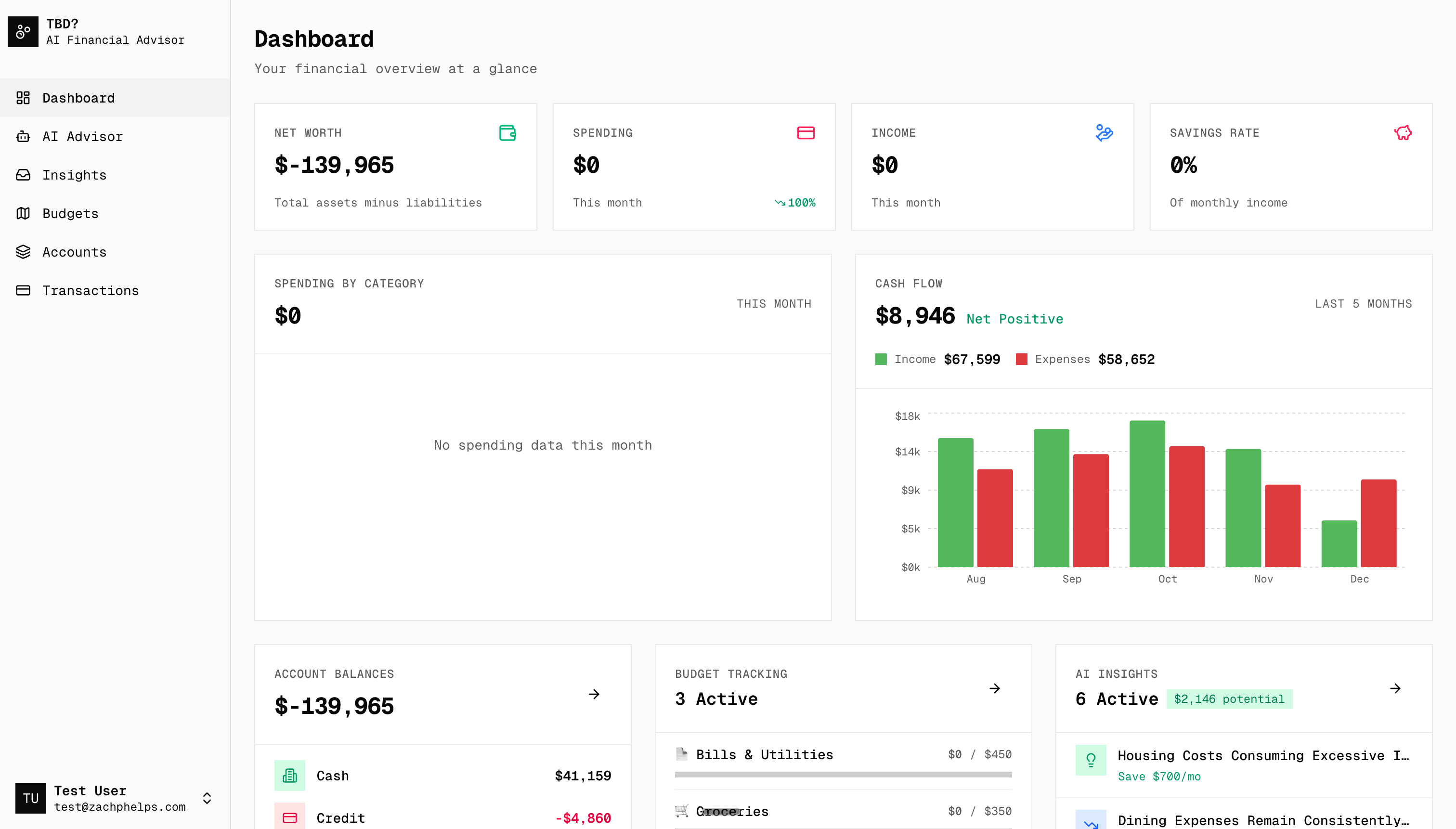

Dashboard & Tracking

The dashboard provides a comprehensive financial overview with net worth tracking, monthly spending trends, income analysis, and savings rate calculations. Users can view 6-month cash flow charts, track budget progress, and monitor account balances—all from a single, glanceable view.

Technical Challenges

- Designing a tool-calling architecture that enables the AI to perform complex multi-step financial analysis

- Building approval workflows that prevent accidental budget modifications while maintaining conversational flow

- Creating an insights engine with deduplication logic to avoid showing repetitive recommendations

Photo Gallery